"Power is not an end in itself, but it is essential for achieving goals."

Nicolaus Machiavelli

In "How Democracies Die", by Steven Levitsky and Daniel Ziblatt, the authors explore democratic decline through concrete studies. They emphasize the importance of leaders committed to democracy and strong institutions to preserve democratic health. The book describes how democracies can collapse not only by military coups, but also in more subtle ways, such as when elected leaders gradually undermine democratic institutions.

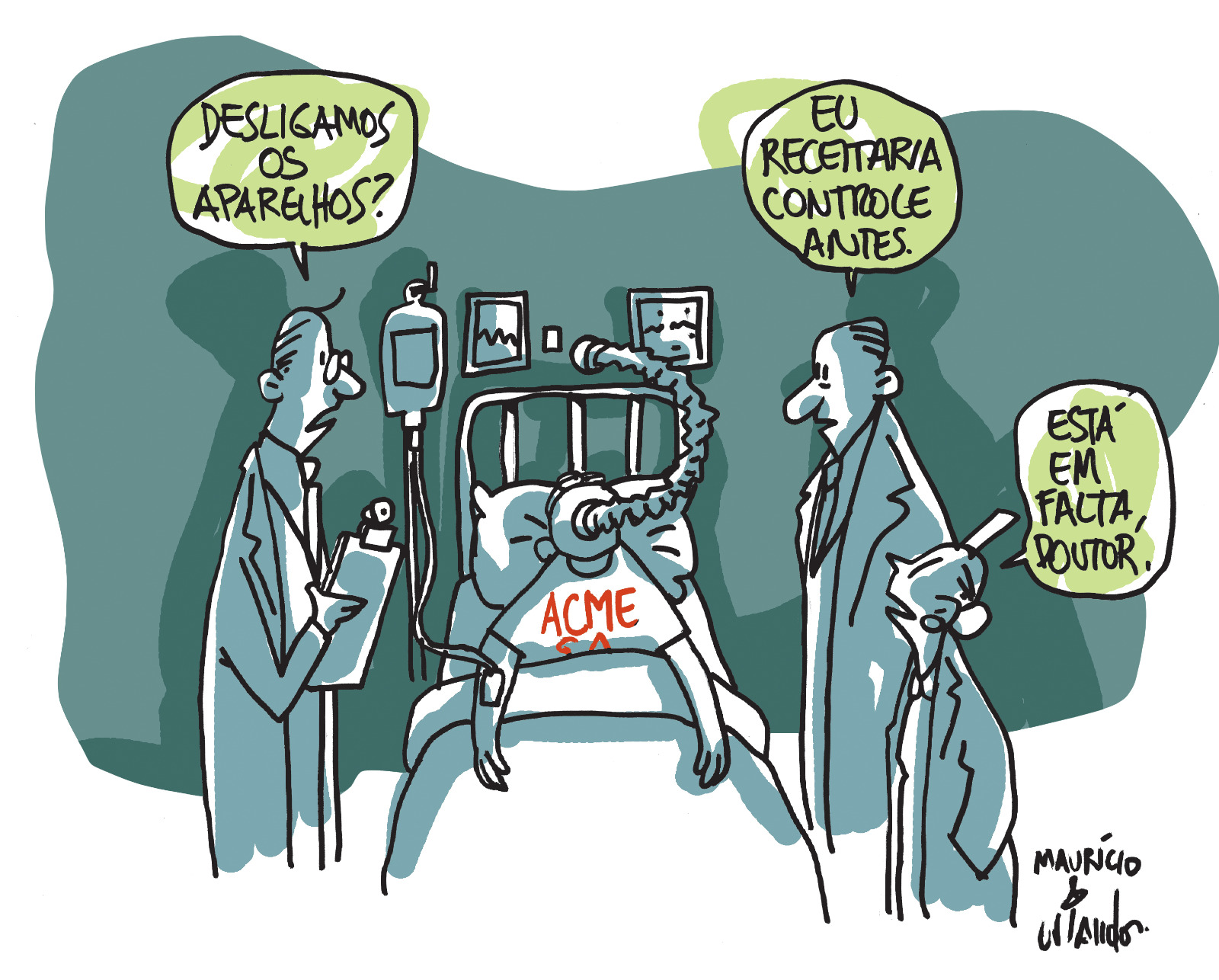

The corporate world is very similar to these definitions. There are many different ways in which a company can disappear. It could be due to the product or service running out on the market, technological change, an accident of extremely serious proportions, a fatal blow to the brand or ruinous financial management. But there is another form of death that is just as subtle, in which, although the company still exists, it loses its relevance in the market and gradually becomes a lethargic, aimless entity, a veritable business zombie.

This collapse usually begins when the company loses control. I'm not referring to the dilution of control in an organized project to issue shares on the stock exchange or by a sale of the company, but by the rise of weak and uncommitted leaders, thanks to the absence of command from the shareholder.

It's not enough to look at a corporate organization chart and see that all the executive boxes are filled. These leaders need to be admired by their team and their peers and respected by the market. They need to be an internal and external reference.

And it is the controlling shareholder who chooses the leadership of a company. Control is the exercise of power. The Corporations Act itself defines the controlling shareholder as having the legal capacity to appoint a majority of the board of directors, combined with the effective exercise of this power. In other words, it's not enough to have the right, you have to exercise it through the decisions you make on a daily basis.

Thus, the controlling shareholder who, through omission, sloppiness or cowardice, fails to exercise his power of control will cause the company to drift, at the whim of the winds, because, in addition to the lack of clear strategic direction, there is a vacuum of leadership references for the company's members. This has consequences ranging from the loss of valuable executives to the loss of the company's credibility in the market.

We can cite Polaroid as an example of the loss of strategic vision; Enron, as an example of governance problems generating a loss of accountability and conflicts of interest; Blockbuster, as an example of stagnation and lack of innovation; HP, for its internal conflicts between leaders that generated dysfunctional decisions that were harmful to the company. In Brazil we have several examples, such as the construction company Rabello, Varig, Encol, Vasp and Mendes Jr (in lethargy) - all of which have in common the absence of effective leadership.

There is a saying in the corporate world that if there is no effective exercise of power by the shareholder, the executives will take over the company, change its culture and start managing it solely for their own personal interests, without the commitment to society established by the company's founder.

The parallels between Levitsky and Ziblatt's book and the corporate world are interesting. Just as democracies depend on shared norms and values, companies also need a solid organizational culture. And when companies neglect or ignore their culture, they risk losing internal cohesion and efficiency.

Both in democracies and in companies, failure to renew, succession of leadership and transition of power also result in the pillars of their support being shaken.

In the same way that political leaders can undermine democratic norms, corporate leaders can make decisions that compromise the health of the company in pursuit of personal gain, leading the company to decline. And fragile companies, lacking market relevance and strong command, are susceptible to coma or disappearance.